Brexit's Effect on New York's Ascent as a Main Monetary Center

A new review by Duff and Phelps shows that New York has surpassed London as the main worldwide monetary focus, basically because of the repercussions of Brexit. The yearly Worldwide Administrative Standpoint study included reactions from 180 chiefs across different areas, for example, resource the executives, multifaceted investments, confidential value, banking, and business.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

LATEST POSTS

- 1

Israel approves 19 new West Bank settlements in major annexation push

Israel approves 19 new West Bank settlements in major annexation push - 2

Newly discovered link between traumatic brain injury in children and epigenetic changes could help personalize treatment for recovering kids

Newly discovered link between traumatic brain injury in children and epigenetic changes could help personalize treatment for recovering kids - 3

Triple polar vortex to plunge central and eastern U.S. into Arctic cold through mid-December

Triple polar vortex to plunge central and eastern U.S. into Arctic cold through mid-December - 4

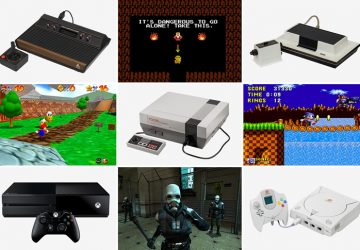

The Main 20 Gaming Control center Ever

The Main 20 Gaming Control center Ever - 5

A definitive Manual for the 5 Off-road Bicycles Available

A definitive Manual for the 5 Off-road Bicycles Available

Share this article

A mom's viral post is raising the question: Do kids need snacks? Dietitians have answers.

A mom's viral post is raising the question: Do kids need snacks? Dietitians have answers. Ancient Pompeii construction site reveals the process for creating Roman concrete

Ancient Pompeii construction site reveals the process for creating Roman concrete Wedding Guest Outraged That Bride and Groom, Who Are in Their 60s and Have Both Been Married Before, Registered for Gifts

Wedding Guest Outraged That Bride and Groom, Who Are in Their 60s and Have Both Been Married Before, Registered for Gifts Monetary Wellness: Planning Tips for Independence from the rat race

Monetary Wellness: Planning Tips for Independence from the rat race The hunt for dark matter: a trivia quiz

The hunt for dark matter: a trivia quiz Change Your Home into an Exercise center with These Famous Wellness Gadgets

Change Your Home into an Exercise center with These Famous Wellness Gadgets Discovery of ancient pleasure boat reveals Egypt's maritime history

Discovery of ancient pleasure boat reveals Egypt's maritime history Netanyahu on Gush Etzion terror attack: 'We will complete war on all fronts'

Netanyahu on Gush Etzion terror attack: 'We will complete war on all fronts' Kremlin: Russian troops conquer Pokrovsk after year of intense combat

Kremlin: Russian troops conquer Pokrovsk after year of intense combat